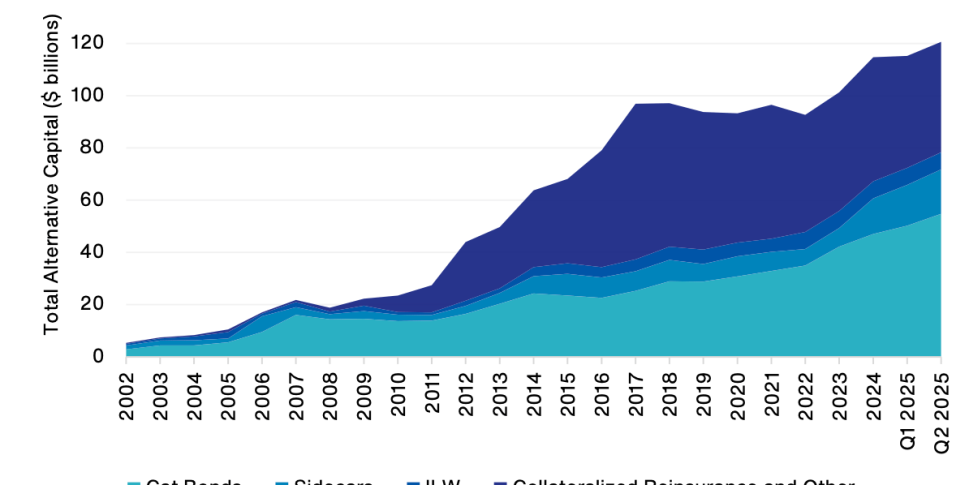

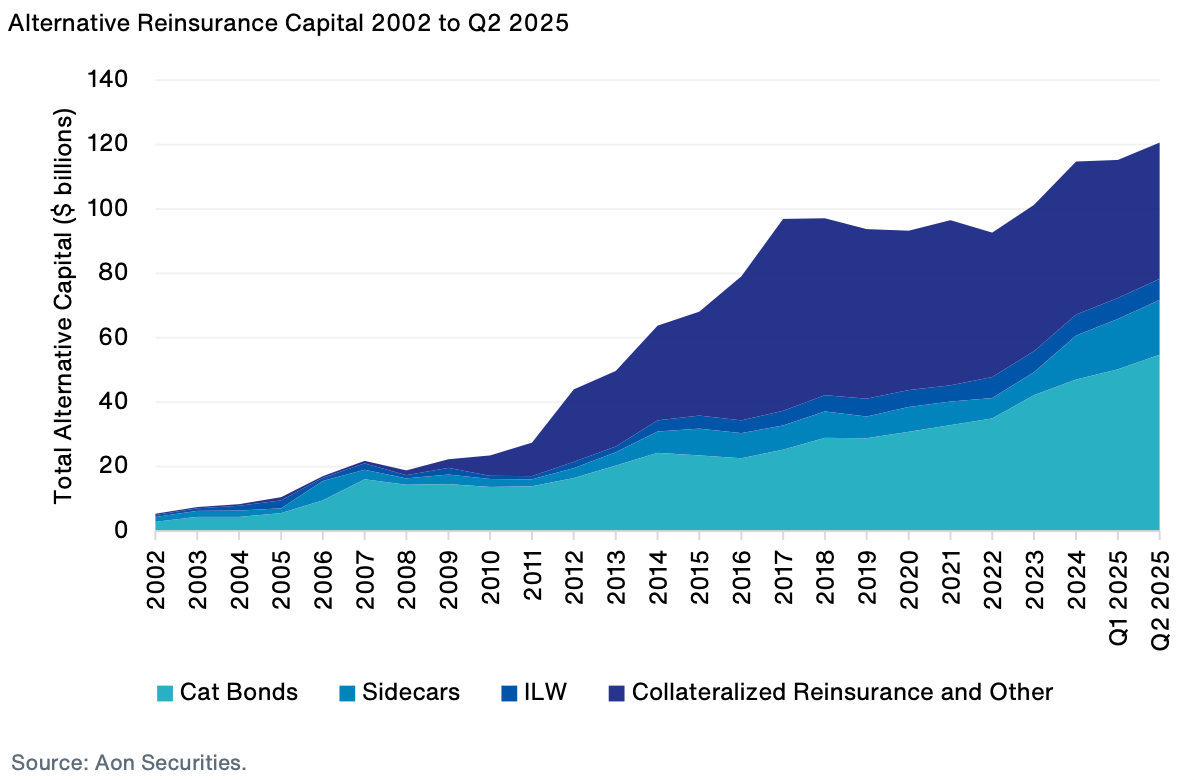

Aon’s latest report has revealed that alternative capital surged to a record $121 billion by June 30, 2025, as cedents increasingly turn to solutions beyond the traditional reinsurance market.

H1 2025 saw the structuring of 56 catastrophe bonds with an issuance total of $17 billion, matching the full-year 2024 total in just six months.

Meanwhile, average deal sizes increased, with H1 2025 transactions averaging $302 million, a 12% rise compared to H2 2024.

Notably, catastrophe bond issuance surpassed $21 billion during the most active 12-month period in ILS history. At the same time, sidecar capacity increased to an estimated $17 billion across both property and casualty lines.

According to Aon, sidecars continued to grow due to their relatively high underlying margins, and the introduction of the casualty sidecar product now accounts for approximately 8% of the overall sidecar market.

Richard Pennay, CEO of Aon Securities, said, “Driven by higher building costs, evolving weather trends and the push to close the protection gap, cedents are increasingly seeking coverage beyond what is available in the traditional reinsurance market.

“With the uncorrelated nature of catastrophe bonds, and investors achieving double-digit returns, the space continues to demonstrate its value and outpace growth in other areas of the insurance industry.”

Elsewhere in the report, Aon highlighted that insurer participation in the catastrophe bond market has increased significantly, with insurers now accounting for 58% of issuances as regulatory and capital requirements drive them toward alternative risk transfer solutions.

The market remains highly concentrated regionally, with 93% of new bonds covering North America, reflecting investor confidence in the region’s risk models.

Within this, Florida-focused issuances rose to $5 billion, a 46% increase, demonstrating strong investor confidence in peak-zone catastrophe protection.

The post Record $121bn alternative capital signals further growth in ILS market: Aon appeared first on ReinsuranceNe.ws.